Get Free Car Insurance Quotes Online

Get Free Car Insurance Quotes Online

What Is a Car Insurance Quote?

A car insurance quote is an estimate of how much you’re likely to spend on car insurance coverage. This is calculated from the type of coverage you select and self-reported information. Each insurer weighs these factors differently, so quotes for the same kind of policy may vary between companies. To get an overall sense of what you’ll pay for a car insurance policy, we recommend comparing quotes from several different providers.

How To Get Car Insurance Quotes

There are a few things to do before looking for free car insurance quotes.

- Set your budget. Before you start shopping for car insurance, you should know how much you can afford.

- Determine your ideal level of coverage. It’s good to know how much car insurance you need — you may be happy with the minimum liability coverage, but comprehensive coverage could better suit your needs.

- Research the insurers you’re considering. Make sure you’re choosing a reliable insurance provider by looking at customer reviews on sites like the Better Business Bureau (BBB) and Trustpilot. Check out a company’s AM Best ratings too, as strong reviews indicate solid finances, meaning the provider can easily pay claims.

- Choose how you want to get quotes. There are many options when it comes to sourcing quotes (both online and in person) which we’ll explain in the next section.

What Information Do You Need for Car Insurance Quotes?

Regardless of which method you choose, you’ll need to provide the following information to get free car insurance quotes:

- Basic personal information: Providers will need your name, contact information, occupation and birthdate.

- Driver’s license information: You and any drivers on the policy will need to provide driver’s license numbers.

- Vehicle information: You should have the vehicle’s current mileage on hand, as well as an estimate of your annual mileage and vehicle identification number (VIN). You’ll also need to state how often you drive and whether or not you use your car for business.

- Five years of driving history: Insurers will want to see any tickets, accidents or other road violations for every driver that will be on your policy.

- Your current auto insurance policy: Be ready to provide information about your current policy and insurance company.

Where Can I Find Free Car Insurance Quotes?

There are a few different methods for getting free quotes and other insurance information.

Local Captive Agents

Captive insurance agents are tied to a specific auto insurance company. They won’t offer you quotes from any other provider, so it won’t be easy to instantly compare rates. You can call these agents or visit their offices to have them walk you through the quotes process.

Independent Agents or Brokers

Insurance brokers and independent agents are authorized to sell policies from different providers. These agents can give you quotes from several companies at once, helping you compare and get the best rates.

Online Quote Tools

Most insurance companies have an instant quote tool on their website, which means you can quickly get quotes from different insurers. Some websites also offer quote comparison tools, saving you even more time.

What to Know Before Shopping for Car Insurance Quotes

As you start your journey to get car insurance quotes online, it can be helpful to know how much you may pay for coverage so you can prepare and budget.

Keep in mind that average quotes can only do so much, as there are several individual factors that go into determining instant and free car insurance quotes from insurance providers.

How Much Is an Average Car Insurance Quote?

The national average for a full-coverage insurance policy is $2,681 per year. This is based on the driver profile of an unmarried 35-year-old with a 2023 Toyota Camry, good credit and a clean driving record.

Here’s a look at some other rates from our 2024 cost data:

| Driver Profile | Monthly Average Full-Coverage Rates | Monthly Average Minimum-Coverage Rates |

|---|---|---|

| Clean driving record | $223 | $72 |

| Speeding ticket | $270 | $92 |

| At-fault accident | $299 | $108 |

| DUI | $323 | $129 |

| Poor credit | $446 | $268 |

What Factors Determine My Car Insurance Quote?

Auto insurers compute quotes differently, but they all tend to use the same determining factors. These include:

- Location: If you live in an area that has high rates of property crime or car accidents, you may see higher car insurance rates.

- Age: Teen drivers and drivers over 55 years old typically pay the most for auto coverage.

- Driving record: If you have any traffic violations on your driving history like speeding tickets, DUI convictions or recent at-fault accidents, you’ll likely pay higher premiums.

- Credit history: A higher credit score means a lower car insurance premium (except in California, Hawaii, Massachusetts and Michigan).

- Gender: Providers (outside of California, Hawaii, Massachusetts, Michigan, North Carolina and Pennsylvania) may give you higher or lower car insurance costs based on the gender listed on your driver’s license.

- Marital status: Married drivers (except for those in Massachusetts and Michigan) usually pay less for car insurance than single drivers.

- Type of vehicle: Higher-end vehicles like luxury or sports cars are more expensive to maintain and therefore more expensive to insure.

The deductible you choose also determines your quote. When filing an insurance claim, the deductible is the amount you pay out of pocket before your policy kicks in. The higher the deductible you select, the lower your total insurance cost will be.

Another important factor in determining your quote is your selected coverage option. If you opt for a policy that simply satisfies your state minimum auto insurance requirements, you’ll get a quote for a much lower amount. But if you choose a full-coverage policy or add additional types of insurance, your quote will be higher.

What Types of Coverage Can I Choose From?

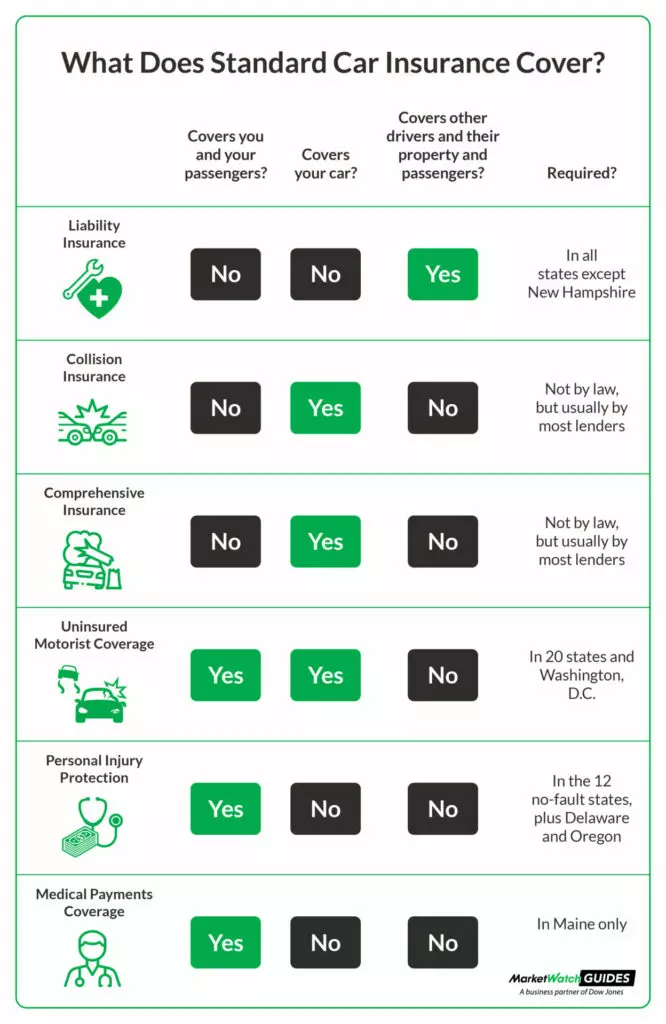

Almost all states (except for New Hampshire) legally require drivers to hold auto insurance. Typically, drivers need to carry liability insurance at minimum. If your car is financed, you may be obligated to have full coverage per your lender.

The standard types of auto insurance coverage are:

- Bodily injury liability insurance (BI): BI covers the medical bills, lost wages and pain and suffering expenses for another party after an accident you cause.

- Property damage liability insurance (PD): PD covers the cost of repairs to another party’s vehicle or other physical property if you’re at fault for an accident.

- Collision coverage: Collision covers accident-related damages to your vehicle regardless of who’s at fault.

- Comprehensive insurance: Comprehensive covers damage to your car from non-collision incidents like vandalism, theft, fire, floods or natural disasters.

- Medical payments (MedPay): MedPay helps cover medical expenses for you and your passengers in the event of an accident no matter who’s at fault.

- Personal injury protection (PIP): As with MedPay, PIP covers you and your passengers’ medical bills after an accident. It can also cover some funeral expenses.

- Uninsured motorist coverage (UM/UIM): This insurance helps cover your medical costs and vehicle repairs if you’re hit by an uninsured or underinsured motorist.

Get Free Car Insurance Quotes: The Bottom Line

A car insurance quote is an estimate of what you may pay for an insurance policy based on the personal and vehicle information you provide. Each company calculates quotes differently, so it’s a good idea to compare several quotes before committing to a provider.

Top Auto Insurance Recommendations

The best way to find insurance rates that fit both your budget and needs is to compare quotes from different providers. We recommend starting with State Farm and Geico, two of the top auto insurers on the market.

State Farm: Best Customer Experience

State Farm is the largest car insurance company in the nation, known primarily for its below-average rates. The company has many agents across the country as well as an online tool, making it easy to get free car insurance quotes. In addition to the standard offerings, State Farm also provides a variety of add-on insurance options, including roadside assistance and rental car reimbursement. Because of its offerings, affordability and high customer ratings, we named it Best Customer Experience in our 2024 industry review.

Geico: Best for Budget-Conscious Drivers

Geico is an excellent option if you’re looking for cheap car insurance, since it offers high coverage limits at low prices, which is why we named it Best for Budget-Conscious Drivers in our 2024 industry review. Geico also offers multiple car insurance discounts to help you save even more. For example, you can reduce your premium by bundling your auto coverage with renters or homeowners insurance. Though the company has fewer captive agents than other insurers, it does have an instant quote tool on its website.

Comments

Post a Comment